- FY2018 Earnings and achievements

- Exercising leadership to take on three challenges

- Medium- to long-term growth

- Bolster our non-financial assets

- Message to stakeholders

FY2018 Earnings and achievements

Adapting to changes in the business climate to grow steadily in each segment

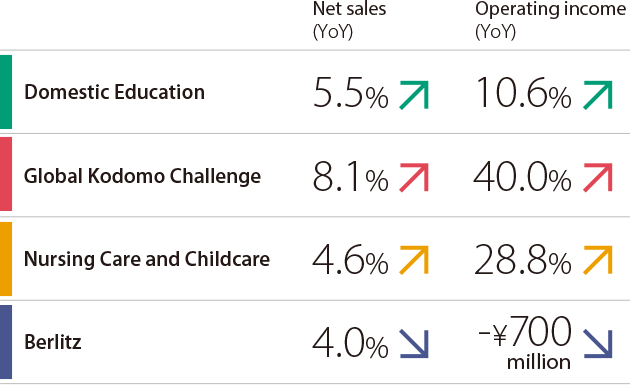

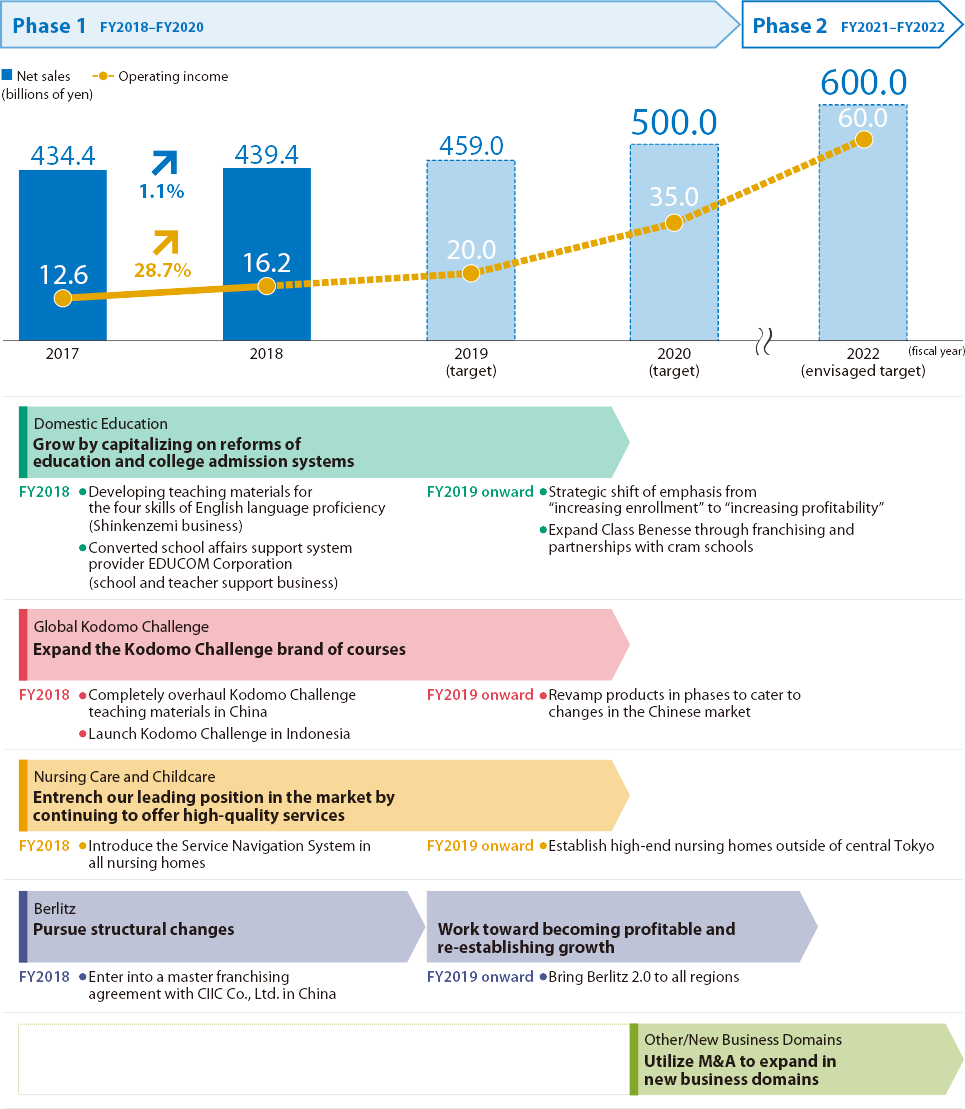

Our consolidated sales grew for the second consecutive year (+1.1% year-on-year) to 439.4 billion yen in FY2018, the first year of our five-year medium-term management plan called Transform and Grow Benesse 2022. This may look like a small increase numbers-wise, but I wish to point out that this total no longer includes sales figures (12.6 billion yen from the previous year) from TMJ, Inc. which we sold off last year. This means that our other businesses have compensated for that amount and more to produce this increase.

In terms of income, we posted increases in both operating income and ordinary income, with 16.2 billion yen (+28.7%) and 12.1 billion yen (+31.3%) respectively. Net profit may have decreased to 4.9 billion yen (-60.5%) but the main reason for the large decrease was fallback after the extraordinary gain posted from the sale of TMJ, Inc. last year.

Looking back on FY2018, I consider it to have been a year in which both our achievements and challenges came into clearer focus. I will go into more detail later about the challenges that warrant immediate action, but I believe it is safe to say that the earnings of the group as a whole have grown because we have worked on initiatives in each segment that are adapted to changes in the market and business climate.

Numerous changes are sweeping through the domestic education market in which we do the bulk of our business in the Benesse Group. In addition to reforms of education and university admission systems starting in 2020, these also include emphasis on the four skills of English language proficiency (listening, reading, speaking, and writing), accelerating the start of mandatory, graded English education in elementary schools, and greater interest in making computer programming education compulsory. At the same time, the rapid spread of digital learning through smartphones and tablets is causing competition in the market to intensify.

With these changes taking place around us, we have actively extended our product and service offerings with the customer’s point of view in mind in domestic education, including expanded adoption of the GTEC test for the four skills of English language proficiency, while also successfully growing our core Shinkenzemi business and our business in school and teacher support. Tokyo Individualized Educational Institute and Tetsuryokukai have also solidified their positions in the cram school industry. With use of ICT on the rise in school settings, we added EDUCOM Corporation to the group in January 2019 in order to leverage their strength in support systems for school affairs to expand the client base of the Classi learning platform for schools.

Benesse Style Care operates in nursing care and childcare, another of our business pillars, where steady increases in the number of our nursing and elderly homes plus improvements to their occupancy rates have led to stronger business performance amidst ever-increasing needs due to Japan’s super-aged society. However, the shortage of available labor in nursing care is now a major problem, and Benesse Style Care is no exception. We began making advancements with better working conditions starting in 2017 that have stabilized staff retention, but unfortunately there was an increase in turnover for some staff in the second half of last fiscal year. We are planning new educational programs in FY2019, as we put systems in place that help us continue to offer our occupants a high level of service.

Click here for more information about the medium-term management plan

The progress and primary activity of the medium-term management plan

Close

Measures to address challenges and achieve further growth

Exercising leadership to take on three challenges

In addition to the aforementioned achievements, we are also aware of our challenges. The three major challenges which must be addressed promptly are as follows, and we will exercise leadership in pushing forward with reforms.

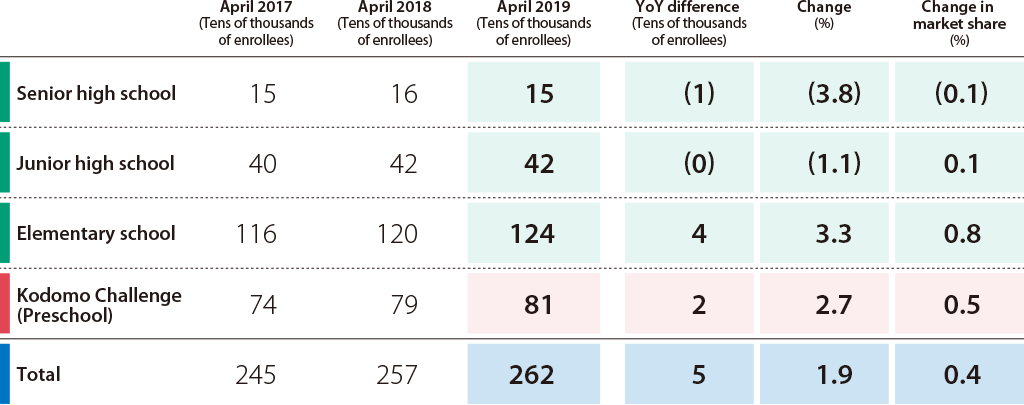

●Overhaul the Shinkenzemi business

One of these challenges is to overhaul the Shinkenzemi business. The significant fall in enrollment suffered in this business following the leak of personal information in 2014 has bottomed out and has now turned toward recovery. In an effort to bolster our product offerings, we rolled out Level-Specific English Four Skills Training materials in FY2019. Our customers had a very positive response to how it enables individuals to learn according to their skill level, from the basics all the way up to university entrance examination material, regardless of their grade in school. Still, enrollment is not recovering at the pace we had initially anticipated. As of April 2019, enrollment remained at 2.62 million, an increase of 50,000 year-on-year which fell short of our target of 2.74 million.

We found the biggest problem to be that when comparing the new enrollment to the sales cost invested in attracting them, our sales efficiency is actually lower than expected. In our medium-term management plan, we set out the goal of increasing enrollment to 3 million by 2020, but if we were to lay out the sales costs to try to achieve this number it would significantly damage our profitability.

Having reached this conclusion, we decided to shift our strategy from “increasing enrollment” to “increasing profitability.” From now on, we will be seeking not only to boost new enrollment, but also to achieve steady growth in enrollment by emphasizing retention and not engaging too heavily in inefficient sales.

We see overhauling the Shinkenzemi business model itself to be a pressing concern. While Shinkenzemi is an iconic Benesse business, the market climate and the value that customers demand have been rapidly changing in recent years, and our competitors have expanded their presence. As Japan’s birthrate has continued to decline and we reach an age in which everyone can enter a university, student types have diverged faster than we expected into the extremes of children who aim high and work hard at their studies, and children who do not. We now need an approach tailored to each and every child, utilizing the respective characteristics of paper and digital mediums. As a result of these changes we have a strong awareness that we cannot simply keep doing things the way we have before. Therefore, we will begin working on drastic reforms now with medium- to long-term growth in mind.

When I assumed the role of president two and a half years ago, it was my belief that we should get back to fundamentals and do business in a way that utilizes our strengths. However, I strongly believe now that we will need to create new strengths in order to overcome the immense turbulence immediately ahead. I intend to pursue drastic reforms of our products and sales methods, and work toward reforming our business model itself.

●New growth for Kodomo Challenge in China

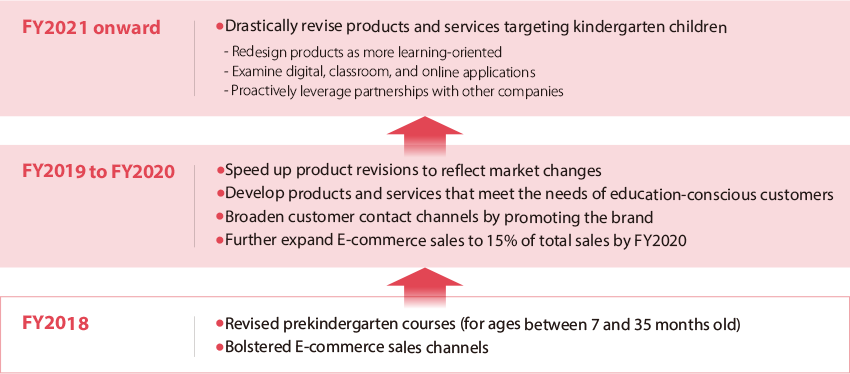

Generating new growth for our Kodomo Challenge business in China is also a very significant challenge. Enrollment in China continued to increase in FY2018, but the pace of this growth has slowed down compared to the roughly 20% year-on-year growth we experienced several years ago. One reason is that we stopped expanding the regions where the service is available, but that was not the only reason. Our analysis shows another major reason was that we lagged at updating our products.

As backlash to overbearing emphasis on studying for entrance exams (examination-oriented education) starting in early childhood in China, the country is now turning to the importance of developing a variety of qualities and human character traits in children (quality education). Benesse is focusing on quality education utilizing Shimajiro (marketed in China as Qiaohu) just as we are doing in Japan, and response has been positive, but on the other hand we believe that we also have to satisfy the needs of education-conscious customers. Utilizing the expertise and digital technologies we have accumulated in Japan, we will develop educational materials catered to both examination-oriented and quality education, giving ourselves new strengths in Kodomo Challenge.

We already initiated reforms geared toward generating new growth last year, completing a full overhaul of our products for prekindergarten courses (for ages between 7 and 35 months old) while bolstering efforts in E-commerce channels. As a result, prekindergarten course enrollment in April 2019 was 6.6% higher than the previous year, and our retention rate had also increased by 6.1%. Going forward we are planning two phases of reforms to drastically restructure our business model in China with medium-term growth in mind.

For the first phase we plan to completely revise our products according to changes in the market over the next two years. We will develop products and services for education-conscious customers, broaden customer contact channels by promoting the brand, and expand our E-commerce channels even more. Then, for the second phase starting in FY2021 we will drastically reconceptualize our courses for kindergarten children according to the nature of the rapidly changing market in China.

Education-conscious customers in China have even more intense needs than in Japan. We will re-accelerate growth by thoroughly understanding and catering to their needs. In a way, we see this is a topic of even greater urgency than overhauling Shinkenzemi.

●Reform our Berlitz business

Another challenge is to reform our Berlitz business. Net sales for Berlitz in FY2018 were down 4% from the previous year, producing deeper losses with an operating loss of 4.7 billion yen. The main reasons were declines in the number of lessons in language services (BTS) and the number of students in our support for study overseas (ELS). In addition to declining revenues, restructuring costs were also one of the reasons for lower profitability. Of course, we naturally expect to see improvement effects from the restructuring, but those effects have not yet become apparent.

We believe that reforming the cost structure and transforming the products and business operations are issues that require urgent action within Berlitz. Since the market is steadily growing in Japan but there are various challenges standing in the way in other markets, we are pushing forward with major structural reforms to morph Berlitz into an entirely new company.

In terms of products and services, we are working to develop a new program as part of a company-wide reform project called Berlitz 2.0. This is an entirely new style of language learning program in which online lessons and e-learning are made available in addition to the traditional face-to-face classroom lessons, organically combined with the latest in digital learning material based on Berlitz courses of study. Connecting teachers with students through smartphones and computers makes it possible to utilize the high-quality language learning programs of Berlitz anytime, anywhere in the world.

Since no other industry players are providing high-quality services like these worldwide yet, we expect that the top line of Berlitz could grow again substantially if these efforts are successful. With soft launches currently under way on a regional basis, we plan to fully roll out these services to all regions around the end of the year.

Reforming the business of Berlitz means not only changing up the products but reforming the awareness of its employees as well. In May of this year we held a meeting with on-site staff at the head office of Berlitz in the US and found that the people currently in charge there are very highly motivated, with infectious ambition. The people they hired to lead their digital marketing are also extremely talented, with experience working in digital marketing for cutting-edge companies at the forefront of digital technology. They have already begun producing tangible results.

We must successfully achieve genuine transformation in response to the three challenges above in order to keep Benesse growing into the future. Internally we are also taking every possible opportunity to spread the awareness of 2019 being a “year of transformation.”

Medium- to long-term growth

Leveraging our collective capability to generate new forms of education

Expanding our main business in domestic education is essential for the Benesse Group to achieve medium- to long-term growth. With major changes sweeping through Japan’s educational system, we will need to provide new services in each segment that cater to new demand. We know that this is not something we can accomplish simply by extension of our existing business operations. We need to make full use of the advantage Benesse has in collective capability to create new forms of education with medium- to long-term growth in mind, and we need to start doing so right now.

One path forward is developing the four skills of English language proficiency. We have already rolled out Level-Specific English Four Skills Training materials in Shinkenzemi and in school and teacher support. We are expanding our curriculum for the four English skills in cram schools as well. In this sense the four skills of English have an impact across all our business segments.

We also see tremendous potential in new business utilizing digital data. These initiatives leverage the vast data owned by Benesse, with our broad customer base.

Another path forward is supporting education for companies and working adults. As Japan’s population ages and birthrate falls, we will bolster our approach to the educational and learning needs of working adults. While we already provide some services in this field, we are working toward creating and providing highly-marketable corporate curriculum based on an online education program for individuals which we are developing jointly with Udemy in the United States.

We are also working on organization-wide projects geared toward creating new business. As an example of this, in our “Future Learning Project” (“Kore-mana”) we are reviewing the possibility of establishing new next-generation learning services that take place outside of school, and we have begun research on the topic of developing products for STEAM education.

Wide-ranging initiatives such as these can only truly be achieved by a company with the collective capabilities of Benesse, which can operate in fields ranging from correspondence courses to elementary, junior, and senior high schools, cram schools, universities, and even education for working adults.

Bolster our non-financial assets

Integrating our accumulated knowledge and expertise into digital mediums

Our greatest strength at Benesse is the capability of our human resources, which is what fuels our growth. I have been continuously conducting round-table discussions, visiting different departments on a regular basis to share thoughts with our employees in their workplaces. In these discussions, our team members in school and teacher support have shared very serious opinions on the topics of how education should be conducted in Japan going forward, and how to give tangible form to educational goals in the classroom. The same is true in our nursing care and childcare settings. It truly struck me that every day these people are continuously asking themselves what they can do for children, what they can do for seniors, and what they can do for the future of Japan. This high level of motivation is the source of Benesse’s strength. It is also what enables us to provide the high-quality services we are known for in educational and nursing care settings.

However, when thinking about sustainable growth going forward, we cannot assume that the knowledge and expertise we have accumulated in educational and nursing care settings will be enough. This is where possibilities such as so-called “digital transformation” come into play, integrating our products and services with digital technologies. I believe that this is something we need to be aware of in our overall strategy for the Benesse Group and all aspects of our business. With this in mind, I have been vigorously spreading the message throughout the company that “if we can’t work with digital, our company will not survive.”

Taking that into consideration, what our Group needs more than anything right now is human resources who not only possess knowledge and expertise in education, nursing case, and our other business areas, but who are also highly motivated and have skills in digital technology. Under the leadership of the Group Digital Division established in January of last year, we launched an initiative to educate employees that embody the Benesse philosophy so they can also be strong in digital. Doing things this way may take a little time. However, rather than simply relying on outside players, I believe this path will surely give us more of the human resources that Benesse truly needs.

I also think that we need to build mechanisms that help our staff stay highly motivated and successful in nursing care, where it has become particularly difficult to acquire human resources. Specifically, we will establish internal certifications for the Benesse Method which could be considered the fruit of our expertise in nursing care, while also creating specialized career paths, and establishing mechanisms to pay remuneration that is commensurate with skill improvements. This will ultimately boost our service level while at the same time improving our retention rate.

Another important human resources topic is developing the leadership for the future of the Benesse Group. In the next generation leadership development project that we launched last year, we provide leadership training to around 20 selected executive management candidates from each department every year. Additionally, the Benesse University development program for young employees which we also launched last year is still going strong.

Furthermore, the Benesse Group also carried out a major non-financial initiative with the establishment of our Sustainability Vision in January 2019. The purpose of this vision was to clearly demonstrate to everyone both internal and external that our group is an enterprise that addresses social issues such as the SDGs head-on. Education and nursing care are both directly linked to social issues. Thus, expanding our businesses in these areas will in and of itself contribute to solutions for these issues. In this sense, Benesse can be considered a pioneer in sustainability. With this in mind, we have also established a Sustainability Committee to be the organization that spearheads activities based on the sustainability vision. Going forward, the Sustainability Committee will be instilling this vision throughout the company, while also clarifying specific key action items. We hope the committee can promote suggestions originating from the worksites, while also backcasting from our goal of what we aim to be in 2030 in order to clarify the key issues (materiality) that we need to address.

Message to stakeholders

Challenging ourselves to transform, with a sense of excitement and urgency

There were a number of circumstances arising in FY2018 that we did not anticipate at the outset of the medium-term management plan, and as a result we lowered our target operating income in FY2019 by 5 billion yen to 20 billion yen. First, I want us to achieve this goal with certainty, and then look to take on the next challenge.

For this next challenge we must not fail to take measures to address the issues that have been identified and work as hard as we can toward transformation. We need to build the foundation for new businesses that will be in place within two or three years and create the future for Benesse that will continue for the next 10, and even 20 years.

As I mentioned before, FY2019 is a year of transformation for Benesse. With a sense of excitement and urgency, we will push forward with these transformations.

Last updated : 2019/10/09

- Top

- Invester Relations

- Benesse Integrated Report 2019

- Message from Management