Message from the CFO

We will steadily achieve our medium-term management plan by strengthening existing businesses and investing in new businesses

Shinsuke Tsuboi

Managing Executive Officer, CFO (Chief Financial Officer),

Executive General Manager of Finance and Accounting

- Recovery in the Education Business in Japan led to an increase in sales and profits for the entire Group

- Further raising ROE and ROIC by improving capital efficiency in the nursing care business

- Actively investing in growth while fortifying our financial foundation

- Linking ESG initiatives to the enhancement of economic value

- Steadily achieving the medium-term management plan by steering from selection and concentration to growth

Recovery in the Education Business in Japan led to an increase in sales and profits for the entire Group

The Benesse Group’s medium-term management plan positions fiscal 2021 to 2022 as Phase 1 with the goal of recovering business results to the levels recorded in fiscal 2019, before the COVID-19 pandemic. In fiscal 2021, we made smooth progress toward this goal. Net sales increased 1.0% year on year to ¥431.9 billion, while operating income increased by 54.1% to ¥20.1 billion, surpassing initial forecasts by a huge ¥17.5 billion and drawing close to the ¥21.2 billion recorded in fiscal 2019. Net income attributable to owners of the parent decreased 65.9% to ¥1.0 billion due to the booking of special losses accompanying the sale of the Berlitz business, but we still managed to secure a profit.

The biggest story in the fiscal 2021 business results was the recovery of the education business in Japan. The prep school and classroom business and school and teacher support business in particular suffered from big falls in results in fiscal 2020 due to the impact of the pandemic, but in just one year they have recovered to levels that exceed fiscal 2019 results. Another notable event was the sale of the Berlitz business, which has been an issue for the Group for a number of years. While the sale did incur special losses, we were able to complete it within the fiscal year so that there will be no negative impact from fiscal 2022 onward. The special losses are a temporary factor, so we can expect to see positive effects from the sale in fiscal 2022 and beyond.

Overall, the implementation of our medium-term management plan is going smoothly, but there are still some issues regarding our main businesses. One is that as of April 2022, enrollment at our Shinkenzemi business has fallen by around 8% year on year. This is due to a combination of declining birthrates and the prolonged effects of the pandemic. The spread of the Omicron variant in the second half of fiscal 2021 caused a succession of school and class closures across Japan and the resulting increase in homework meant that the amount of time children had to learn at home was limited. We have also come to the conclusion that a growing sense of unease about family finances has affected the use of home learning services. However, the Shinkenzemi business has been monitoring the decline in birthrates for several years and has been shifting its focus from acquiring new enrollment to raising retention rates. It is working to secure profitability by combining digital teaching materials with support provided in person to steadily increase the number of frequent users, as well as by expanding services that meet the diverse educational needs of children, such as providing online learning through Challenge School.

In the nursing care business, occupancy rates at our nursing homes are taking longer than expected to recover. This is mainly because of the prolonging of the COVID-19 pandemic and many new applicants decided to postpone the date of their occupancy due to declarations of a state of emergency in several regions. However, our nursing homes have always been very highly regarded by residents and as the pandemic began to abate in spring 2022, we saw recovery trends in resident numbers and occupancy rates. We have also started taking a new sales approach toward regional healthcare institutions and care managers, so we expect to see a gradual improvement toward our targets going forward.

Further raising ROE and ROIC by improving capital efficiency in the nursing care business

We are aiming to raise corporate value by improving capital efficiency. In our medium-term management plan, we have set the target of achieving ROE of at least 10% by fiscal 2025 and we have introduced ROIC as an indicator with the aim of enhancing the earning power of each business. We had been hindered by losses recorded by the Berlitz business over the last few years. However, the sale of said business means that a negative factor has been removed from fiscal 2022 onward and it will also have a positive effect in terms of taxes over the next few years.

Therefore, ROE and ROIC should both improve rapidly. In fiscal 2022, ROE is forecast to surpass 8% while ROIC is forecast to improve beyond our current weighted average cost of capital (about 5%). We will aim to hit our ROE target of at least 10% ahead of schedule in fiscal 2023.

Looking at ROIC by business, the nursing care business, which has to treat real estate leases in its accounts, is lowering the overall average. The nursing care business is an asset heavy business, so we have been told by shareholders and investors that we should concentrate business resources on the education business instead. However, it also offers stable cash flows, and we are striving to improve capital efficiency by expanding ancillary businesses that do not require actual facilities, such as staff dispatch and referral services. In fiscal 2021, we made Heart Medical Care Co., Ltd., which provides nursing care personnel referrals among other services, into a consolidated subsidiary.

A very large portion of the Group’s businesses take payments from customers in advance, so we need to keep a certain amount of cash in reserve to maintain a sound financial position, which is a limiting factor from a capital efficiency perspective. We will manage this reserve more efficiently and reduce fixed costs to raise ROE.

Actively investing in growth while fortifying our financial foundation

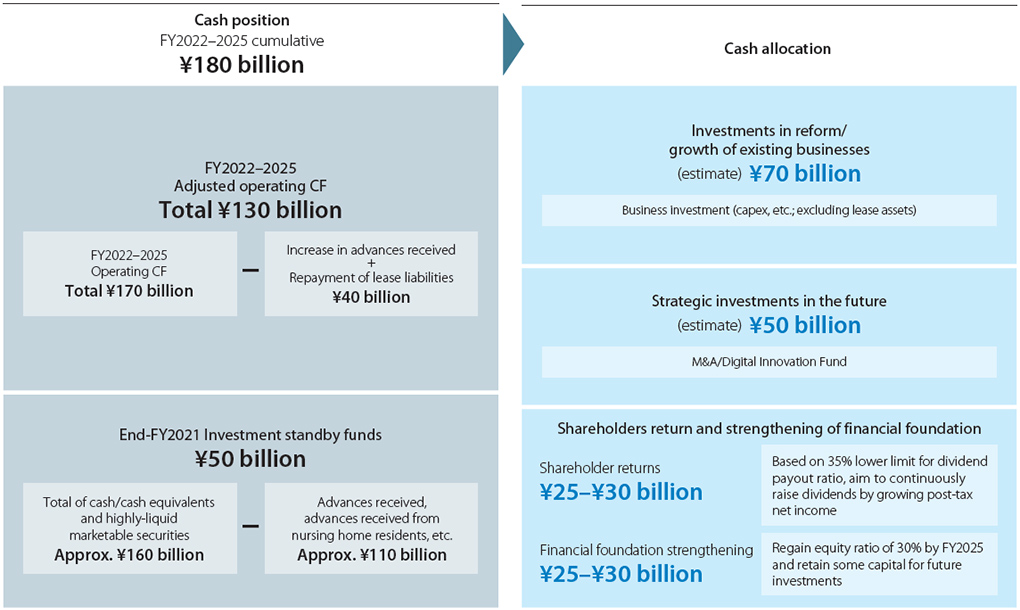

At the start of fiscal 2022, the second year of our medium-term management plan, we disclosed our cash position up to fiscal 2025 and our approaches to growth investment and shareholder returns. In fiscal 2025, the final year of the plan, we forecast that cumulative adjusted cash flow from operating activities will have increased by around ¥130.0 billion. When combined with ¥50.0 billion in investment standby funds at the end of fiscal 2021, it results in an anticipated cash position of about ¥180.0 billion over the next four years.

Our basic policy for the allocation of these funds is to balance growth and strategic investments and shareholder returns with efforts to fortify our financial foundation. We plan to spend ¥70.0 billion on business investments, primarily expanding products and services in existing business fields, funding new products, and IT investment. We will also allocate about ¥50.0 billion for strategic investments aimed at inorganic growth, such as M&A and funds for use by the Digital Innovation Fund (DIF), which we established in November 2021.

We also plan to allocate a total of around ¥25.0 to ¥30.0 billion for shareholder returns over the four years. If actual results are in line with plan forecasts, we expect to be able to raise the dividend each year from fiscal 2022 onward, even under the assumption of a 35% payout ratio. In fiscal 2022, we plan to raise the annual dividend by ¥10 to ¥60 per share.

Approach to cash position and allocation

Linking ESG initiatives to the enhancement of economic value

As a Group that delivers services in the socially important fields, including education and nursing care, we should be putting a greater emphasis on ESG activities than other companies. Therefore, it is essential that we ultimately link the enhancement of non-financial value to the enhancement of financial value. With this in mind, we will be setting non-financial KPI for each company and business from fiscal 2022 and we are currently discussing how this will be monitored at meetings of Benesse Holding’s Management Council.

We aim to maximize our corporate value by generating three types of value—social value, customer value, and economic value. There is a certain amount of alignment between customer value, social value, and our ESG-related KPI. We plan to reanalyze the relationship between non-financial KPI and corporate value from this perspective and disclose our findings to external stakeholders in an easy-to-understand manner.

Steadily achieving the medium-term management plan by steering from selection and concentration to growth

One of the important responsibilities of a CFO is to ensure smooth communication with investors and the financial markets. While there may be concerns about the decline in enrollment of our Shinkenzemi business that I mentioned at the start of this message, said business accounts for only around 25% of the Group's operating income. Currently, our education business in Japan has a broad scope, from schools to prep schools and classrooms, and even through to university students and working adults, and we are strengthening efforts in each field. Furthermore, profit contributions from our nursing care business are growing each year. This balanced business portfolio means that we can still achieve corporate growth, even if there is no increase in Shinkenzemi enrollment. I intend to properly explain topics such as our profit structure to shareholders and investors to ensure their understanding.

Although we are improving in many KPI, I am aware that raising our price-earnings ratio (PER) is a challenge. At the release of our fiscal 2021 financial results, our PER was less than 15, which could be seen as a worrying indication regarding the Group's growth potential. I understand some people might be concerned that our main strength is an education business in a country with declining birthrates and that we are also facing factors such as the impact of the weakening yen. However, there is still plenty of room for business growth by expanding our market share, even in the Japanese market, and we are building a solid strategy for achieving this. We will disclose the details going forward, so I hope you will share in my excitement about the future.

We started to wind down our main activities for concentration and selection in fiscal 2021 and we are now moving strongly toward the next phase, which is focused on growth. We will work to achieve our target of ¥40.0 billion in operating income by fiscal 2025, the final year of the current medium-term management plan, by growing our existing businesses and actively investing in new businesses, while staying conscious of financial soundness and capital efficiency.

Last updated : 2022/09/30

- TOP

- Investor Relations

- Integrated Report

- Benesse Integrated Report 2022

- Message from the CFO